The Office for National Statistics published a survey on inheritance in the UK for the years 2008 to 2010 yesterday. It's a telling report. As they note:

The percentage of adults receiving an inheritance valued at £1,000 or more in the two year period was 3.6% - or 1.6 million adults.

Knowing how many individuals inherited as well as the value of the assets received is important. Certain inheritances might carry a strong emotional attachment. However, if inheritances are of little financial value they are unlikely to influence an individual's economic wellbeing or subsequent life choices. For example, inheritances of higher monetary value might permit recipients to pay off their mortgage, help children onto the property ladder or fund their university fees.

A tenth of inheriting individuals received no more than £1,000. Half of inheritors received less than £10,000 — but a tenth received an inheritance valued at £125,000 or more.

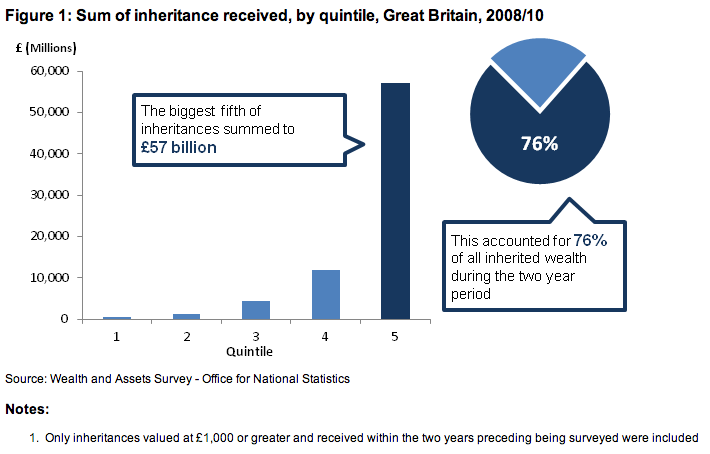

The combined total of all inheritances received over the two year period was estimated at £75.0 billion.

However, such a figure does not tell the whole story:

The inheritances received by a small few had a disproportionately higher value than the majority. Figure 1 illustrates that the sum received by one fifth of inheritors totalled £57.0 billion. This accounts for over three-quarters of the overall amount of inheritance received during the two year period.

This is that table:

What is abundantly clear is that, as we well know, the distribution of the benefit of wealth is deeply unequal.

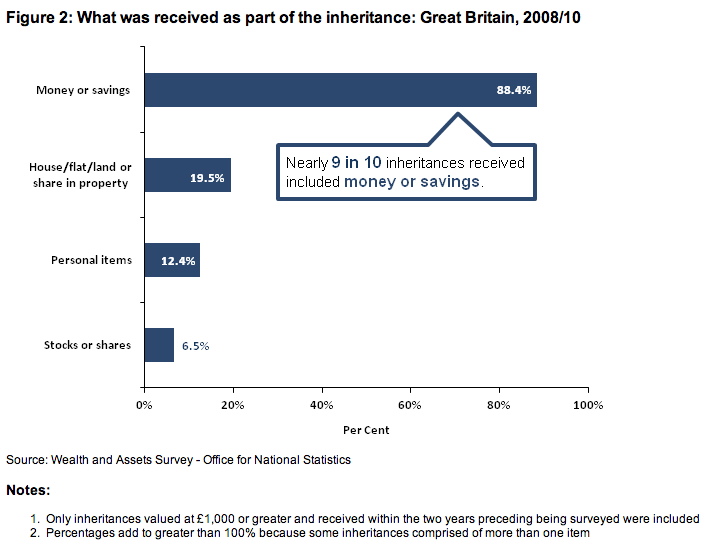

It's important when seeking to understand this to know what is inherited. This table indicates that:

Characteristics associated with an increased likelihood of inheriting included:

- Living in the wealthiest fifth of households -Individuals living in households which already had the highest levels of wealth showed an increased chance of inheriting over individuals living within middle wealth households.

- Working in a managerial occupation - Compared with those working in an intermediate occupation, working in a managerial occupation was found to increase the probability of receiving an inheritance.

- Self-employed - Compared with employees, those reporting their employment status as self-employed had an increased chance of inheriting. As this self-employment is recorded prior to having inherited, this is not direct evidence of inheritance being used as a jumping board to self-employment.

- Owns main residence outright — Compared with mortgage owners, individuals owning their main residence outright had an increased chance of inheriting.

- Father2 was self-employed — Rates of inheritance were higher for individuals whose father was self-employed compared with those whose father was an employee.

- Father had further educational qualifications — Individuals whose Father had attained further qualifications beyond schooling (e.g. a university degree) were more likely to receive an inheritance compared with those whose Father had not attained any qualifications beyond secondary school.

Characteristics associated with a decreased likelihood of inheriting included:

-

Being male - Rates of inheritance for males were lower than they were for females; a finding which may reflect differences in life expectancies between genders.

-

Not of white British ethnicity - Rates of inheritance for those not of white British ethnicity were lower than for those who were white British.

-

Aged 65 years or older — Compared with those aged 45-54 years, individuals belonging to the older age groups were less likely to inherit. This is possibly a result of the reduced opportunity to inherit from others, as older generations might well have already passed on.

-

Working in a routine occupation — Those working in a routine occupation were less likely to receive an inheritance compared with those in an intermediate occupation.

-

Parents rented main residence — Individuals whose parents were renting their main residence were less likely to receive an inheritance compared with those whose parents were mortgage owners.

In other words, inheritance appears to very strongly reinforce patterns of inequality in society, all of which lends strong support for improved wealth taxation in the UK.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Inheritance tax is well overdue for reform – as things stand the exemptions are so absurdly generous that the really rich never pay it. The Duke of Westminster owns half of London. How much inheritance tax will his heirs pay? Likely almost none – the whole estate will benefit from business property relief. There’s a reasonable case for exempting small businesses (as liquidating part of the business to pay the tax may be impracticable or undesirable). However applying this and the other exemptions to billionaires is insane.

We will, however, start seeing significant inheritance tax being made by the London middle classes when the baby boom generation passes their homes to their children (and one would expect the figures above to markedly shift towards the family home making up a larger percentage of assets). To at least some extent this would reverse the recent decades’ redistribution of wealth in favour of London property-owners. Naturally there will be great wailing and gnashing of teeth at this from the usual quarters… one hopes governments stand firm and don’t expand existing reliefs, but given the political clout of the baby boomers I would not be surprised if they do.

I wonder what the average inheritance will be from those who fail to come through the winter in a living condition?

Or maybe even the gov is not so crass as to calculate that, yet?

Having just been notified by my energy supplier that prices will be rising this winter, by rather more than the 8.3% they informed me of since it also involves changes in billing periods and standing charge, I am considering opening the hearth and going to wood open fire. Others have gone back to coal. Smog anyone?

Why not John. Since we’re regressing as a society in so many ways,why not have a bit of smog? After all, plenty of other wonderful characteristics of the last 100 or so years of British history are in their way back. Ricketts, people too poor to eat, the constant attacks on the least well off.

Come to think of it, that fire may come in useful if (or is that when?) the power goes out due to the privatised utilities’ failure to build enough new power stations.

No incentive to build them.

Carbon tax on the way. Onerous planning regulation (excepting on already existing sites), politicians murmuring about prices freezes….prices being higher through enforced buying from expensive sources. etc.

BG, the ones raising prices by over 8%, have also removed the prompt-payment discount (pathetic excuse….unfair competition ruling) and suggested I pay by direct debit….@£85/Month…..with my gas bill running at around £61/Month average….

Well, it looks like checkthemarketforanotherripoffsupplier.com

So, in prep for winter and the “no power cuts this year but maybe next possibly” forecast, the 230v petrol genny is serviced and ready, the 12v-230v inverter is ready, and tested on running the central heating.

I cannot, in honesty, burn coal. My respiratory problems and consideration for others (and the smoke-free stuff)….others can, and do though.

I would be laughing but….the minor surgery on my back, that is not available, yet, on the NHS, is available at the same hospital, with the same surgical team, for cash. Hmmm.

Inheritance tax is very unpopular and not a vote winner……..just look at the abandoned election when the Tories talked about raising the limit to £1m.

However it is certain that wealth taxes would raise useful money and help lessen the inequality imbalance.

Perhaps if you offered to lower another tax in return, such as VAT?

Come on Richard, shock us and think of one tax you would lower!…….(and no it cannot be a benefit change like the bedroom tax)

I opposed the VAT increase to 20%

I’m confused – that graph doesn’t appear to break down the proportion that family homes make up of total inheritance. It just breaks down how many inheritances included property, the answer is 1/5th. But what proportion does that 1/5th represent in terms of value of all inheritances? My guess would be more than 1/5th, possibly quite a lot more. That’s not especially helpful either way and certainly doesn’t tell me whether or not the “family home” argument is significant.

I think inheritance should be taxed at 100%, for what it’s worth (with deductions for charity and relief for business property or total exemption for children aged under 18 or still in full time education, etc). I don’t think anyone’s children should automatically benefit from what their parents did or had unless they were a dependent at the time of death; it just encourages laziness.

“I don’t think anyone’s children should automatically benefit from what their parents did or had unless they were a dependent at the time of death; it just encourages laziness.”

Hmm … I undertsand the sentiment but …

It may in some instances encourage laziness, but it has as much to do with parents encouraging that laziness ss anything surely.

When my parents die I may well come into an inheritance – they own a rather nice big house in Bristol. But there has never been an expectation on my part that I will definately get an inheritance and that I can sit on my butt twiddling my thumbs and just wait for the cash to roll in.

Similarly if I die, my kids will get an inheritance. But they’ve not been raised to be lazy and live off mum & dad (not that I could afford to do that anyway). So they’ve been encouraged to find their own way in life. My elder daughter (20) is out at work earning her way already (no way she wants to pay her way through Uni’) and the younger one is studying at the local college with a view to becoming a nurse or midwife.

So it’s not as simple as knowing there’s an inheritance = laziness.

I don’t think you’ll allow this Mr. M but surely even you’ve got to question the idea that the average family home inheritance should be taxed at 100%……

“I think inheritance should be taxed at 100%, for what it’s worth (with deductions for charity and relief for business property or total exemption for children aged under 18 or still in full time education, etc).”

So are you saying that the State should take private property that some family has worked hard for – the average 3 bed semi for instance? Who does the state then give it to? Some long haired layabout who been on welfare for years?

Perhaps then we might go the other way – no tenancies paid for by the public purse. All rents by all landlords to be charged at full market rate – after all then we’ll see just who can afford social housing – don’t forget Bob Crow lives in a council house and pays well below the going rate and he’s on some serious cash. Why not – after all, it’s just as offensive to many as your idea.

What business is it of the state, if parents choose to leave a house to their children? After all in the vast majority of cases, that house will have been paid from taxed income.

I do not agree with 100% taxation

Yep, I have always thought inheritance is the perfect time to tax. Take the lot – why do my children have more of a right to it than anyone else? Your argument re it not being “the business of the state” what people leave to other people isn’t really relevant. Why is it any of the state’s business that people smoke and drink? It’s not, but we tax it to the hilt because we know we can get revenue from it and smoking and drinking is perceived as socially undesirable. You don’t agree with me that inheritance is socially undesirable; that’s fine, most people don’t. I simply think that it’s a good time to tax people and I would rather people worked hard themselves than lived off what their parents worked hard for. To the other poster, I didn’t say that inheritance equalled laziness, I said that it encouraged laziness, which I believe it does. Then I think there should also be a higher and immediate taxation on lifetime gifts (probably not at 100% but with a ceiling above which taxation is 100%).

@Allan, do you really believe that a 3 bed semi bought for £3k in 1960 and now worth £300k, increased its value as a result of the hard work of the gandparents?

Sadly, most people seem to think that this is so.

‘I do not agree with 100% taxation’

So – what % will you take from my children when I have paid every tax the law requires me to do?

I have made, solely on my own initiative, relatively substantial amounts of savings ( which I could have wasted on a Ferrari or something) but which you wish to take most of from my children.

Disgraceful

The falseness in your claim is that you accumulated solely through your own initiative

That us absurd. You did not. The asset was, for a start, protected by the state – even underwritten by it if some us cash

And you did not make it by yourself. You enjoyed all the benefits the state provided in the course of its accumulation.

And so you can quite reasonably be taxed on it. The rate depends upon the amount. I would argue for a progressive, banded tax

The rate should reach at least 50%

Exemptions should be more limited than now

But Max’s view is what many think and I was thinking it through…

First, I can understand the sentiment – If I decided to invest what I earn rather than spend it or waste it on wine, drugs, women, whatever takes my fancy at the timne etc., then why should I be taxed again on those assets simply becasue I have made a choice to save for my children rather than spend it on myself. And bear in mind that the money I am saving/investing is my post tax earnings so I have already paid tax on my income.

During life are only taxed on ‘profits’ be that profit from employment, profit from gains on sale of investments or profuits from a trade. The savings I accumulate are not profits they are the result of my profits so why tax them again.

And that is the crux of the matter quite simply.

But while I was thinking it occured that if I had spent my money on beer, fags, holidayes etc. then I would be paying tax at the time of spend, VAT, duty, airport tax etc etc. whilst if I invested that money or put it aside I wouldn’t be paying any tax – So to an extent by saving/investing I have avoided (for want fo a better word) paying tax by not spending – Obviosuly if I fritter my cash away on illegal stuff like drugs then I still avoid tax but it will only be a minority that do that.

So I sort of concluded that there is some sense in taxing assets/savings on death becasue it redresses the shortfall in tax that the government has suffered through you not buying stuff.

A slightly odd argument and not something I’d thought of before. And much as it pains me, there is a certain logic to it.

The reality is that there is always double taxation – as you have noted

IHT fits that bill

As you note

And I have no problem with that

“The rate should reach at least 50%

Exemptions should be more limited than now”

Very vague statements.

What exemptions do you wish removed? A smaller nil rate band? To what amount? Removal of BPR? ‘at least 50%’? what then? Higher?

And to what effect? IHT raises a very small amount of money as a proportion of UK Government income. Doubling it would make little difference to the government’s debt or deficit but would impact hugely on those families where parents wish to pass on the fruits of their labour to their children. And if that labour was supported by government spending on infrastructure, then that government spending was supported by taxes paid during the individual’s lifetime.

IHT is a spiteful tax.

Your last comment says why it’s not worth responding

IHT is not a spiteful tax, it just needs reform. You’re right in that it raises relatively little money at the moment, but the cold fact is death is a good time to tax for many reasons. The way to make more money from it is to simplify and hike up the rate. There is double taxation when I pay VAT on goods I buy from my after tax income. That doesn’t stop VAT from being a very good tax (difficult to avoid and easy to implement). IHT could be the same if it wasn’t so complex.

I see you asked for specific examples re simplification. Here are mine. I would keep BPR and APR. PETs I would do away with. No nil rate band on death. Perhaps a small nil rate band during lifetime (£100,000) to encourage lifetime giving. Home in occupation relief. 100% exemption for dependents and charities. Can then get rid of GWROB rules, successive transfers relief and all the other specific exemptions (e.g. small gifts, consideration of marriage, annual exempt amount). IHT on trusts could also do with further simplification. Then up the rate. Larger base, higher rate, cheaper to levy.

AB

Thank you for a reasoned response to my posting. Appreciated.

I’d question how you could possibly get rid of PETs. If, (say) a professional footballer aged 25 gave £1m to his brother it would currently be a PET. You’re saying that the £1m should remain part of his estate for IHT purposes?

And no nil rate band? So someone with a few hundred £ in a bank account would suffer IHT on death?

Not at all, I appreciate my views on IHT are quite controversial so enjoy engaging with people about them. Not quite re your footballer example. As you’ll see above, I would also restrict lifetime gifts. Therefore, if our footballer had never given a gift before there would be a tax free amount (say £100,000), above which IHT is due. Yes, no nil rate band because I would be quite happy with 100% IHT on death (subject to the exemptions I describe, without which of course 100% IHT would be unfair/result in hardship of dependents). The main issue I see in all of this is (a) clearly you will still need a lifetime de minimis for gifts (for Christmas, birthdays, marriages) that applies gift-by-gift, and possibly person-by-person, annually and (b) evasion – clearly rates of evasion would be soaringly high if there was a 100% rate of IHT without some sort of automatic enforcement on each death.

So I do accept that the practical issues with 100% IHT might be too difficult to overcome, but in my view if we had 100% IHT that was impossible to avoid it would be a dream tax. This would obviously entail a lot of enforcement costs – HMRC would have to go through a huge amount of information – but costs would be offset by the high rate. That’s because I’m a bit of a freak though, and in my opinion a good tax is one which is difficult to avoid and which brings in more revenue than it costs to levy, while I don’t care a fig about double taxation on imposition of IHT or people’s wishes to leave inheritance to their children.

In relation to the sort of simplification measures I would make to the current IHT system…I think the IHT treatment of trusts is too complicated and the same for GWROB / associated income tax charge. I think those rules could benefit from full overhaul. I also think the PET system doesn’t work that well – I would favour a separate lifetime gift tax which is immediately chargeable to tax. I do think there should be a “home in occupation” relief. The problem is, IHT has in the past been too easy to avoid, and in my opinion the very worst examples of how tax legislation becomes too complex and unwieldy when HMRC is constantly trying to plug holes are in the consequent IHT legislation.

How much would such reforms as your propose cost you and your family?

Probably quite a lot, if I hadn’t refused to take any money from my family, which I did a long time ago.

Not, I would like to stress, that it should matter anyway. Even if my family were not in the position to leave me an inheritance I am capable of forming the opinion that inheritance is socially undesirable. It just so happens that I think inheritance is socially undesirable and in addition I have no desire to inherit money from my parents or leave my own children a legacy, though I am in the position to do so. I would prefer the money went to charity, because I don’t need the extra money and if I raise my children in the way I want to they won’t need it either. In addition, as it currently stands IHT is easier to avoid the more money you have. It’s a tax that favours the healthy and the wealthy and I’d prefer it if it applied equally and was difficult or impossible to avoid. In order to do so, you need to up the rate in any event to cover enforcement costs. I am not persuaded by the double taxation argument in the same way that I am not persuaded by it in relation to VAT.

Comments like yours below “let African kleptomaniac’s buy designer handbags for their wives” are pretty ignorant and make me question why I’m bothering to explain my position to you. At least present a reasoned argument.

“First, I can understand the sentiment — If I decided to invest what I earn rather than spend it or waste it on wine, drugs, women, whatever takes my fancy at the timne etc., then why should I be taxed again on those assets simply becasue I have made a choice to save for my children rather than spend it on myself.”

HMG wants people to save for their own age and be more self-reliant so that they don’t need benefits – thus by saving and passing on, you are in fact in line with HMGs policy and desires.

HMG’s view on self reliance is misguided and results in a massively over inflated stock market valuation

Mr. M, again I’m not sure you’ll let this get through, but anyway, in for a penny in for a pound….

“That us absurd. You did not. The asset was, for a start, protected by the state — even underwritten by it if some us cash And you did not make it by yourself. You enjoyed all the benefits the state provided in the course of its accumulation. And so you can quite reasonably be taxed on it.”

Of course though, through the average persons working life they pay tax every day hence paying back ‘mythical debt owed’ each and every day. After all, no-one has asked me if I’d rather pay for private medical insurance OR the NHS. I have to pay for the NHS and other peoples pensions via NIC etc. even as I’m told to save and save and save for my old age.

“The rate depends upon the amount. I would argue for a progressive, banded tax. The rate should reach at least 50% Exemptions should be more limited than now.”

So after paying tax for years and years (say 45 – 50 working years) and having to pay to into a private pensions / savings scheme, you think it’s fair for the state to say,

“Right, we know you’ve paid tax every day of working life in some way, shape or form, we know we’ve told you to save and save, now we want say 30% of it….to stop your family getting it…we’d rather the cash was used to fund….something like International Aid…..and be used to let African kleptomaniac’s buy designer handbags for their wives…..” (or insert spending choice you disapprove of)

Emphatically I think that is fair

It’s what democracy has delivered

And we all know democracy never suits us all all of the time

But it sure as heck is better than anything else

As we have seen from France. Democracy doesn’t work all the time. There are more French people in London than people from Wales.

@ Carol, you said that, “do you really believe that a 3 bed semi bought for £3k in 1960 and now worth £300k, increased its value as a result of the hard work of the gandparents?”

Leaving aside that one set of my grandparents never owned their own house and the others set built their house up bit by bit over years, in 1960 the average wage per week was about £12 so £3000 was a shed-load of cash to find.

As to luck or hardwork – I suppose depends on your point of view given how the market has behaved and how silly HMG has been about housebuilding over the years…remember though that house bought for £3k had to be paid for out of post-tax income whilst the people living in it also paid tax on just about everything they did.

In any case, I think that a huge rate of IHT is simply wrong – people pay taxes through their lives (well the vast majority do) and I think it is wrong for the state to be demanding a share of the family home as well especially if it is the only asset.

Incidentally, I only know 1 person who lives in a house worth more than £150K and that person doesn’t even live locally.

Average house price per the Nationwide in 1960 was about £2250

The ratio to average wage of £13 was 3.3 times earning

Remarkably low

But it was of course far more difficult to get a mortgage (or any kind of loan) – credit was (compared to today at least) massively tight.

Thus house prices couldn’t rocket as no-one would be able to have afford to buy given how tough credit was to get….

So houses have always been overvalued.