IKEA is a private company. It does not need to publish an annual financial statement ion the form as a quoted multinational corporation. And it doesn’t. But it has (I think for the first time) published a limited annual report. That’s the good news. The bad news is it does not tell us much.

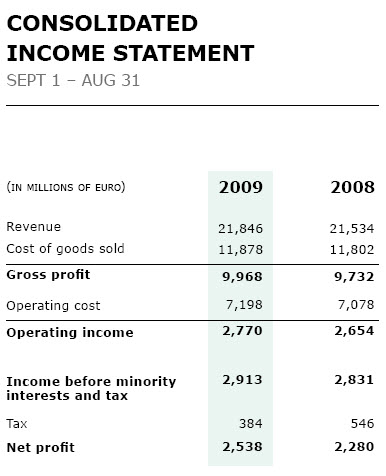

This is the profit and loss account:

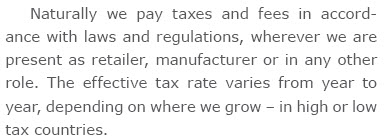

And this is its tax note:

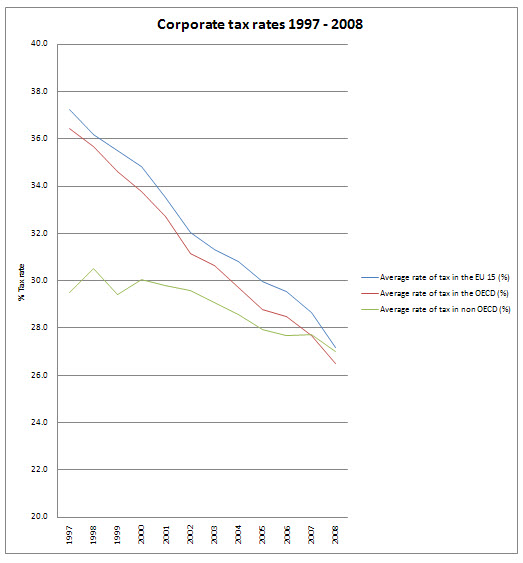

And for the sake of the record, here’s the geographical spread of trading:

So, IKEA makes 79% of its sales in Europe and 62% of its purchases in Europe. It’s a European dominated business then.

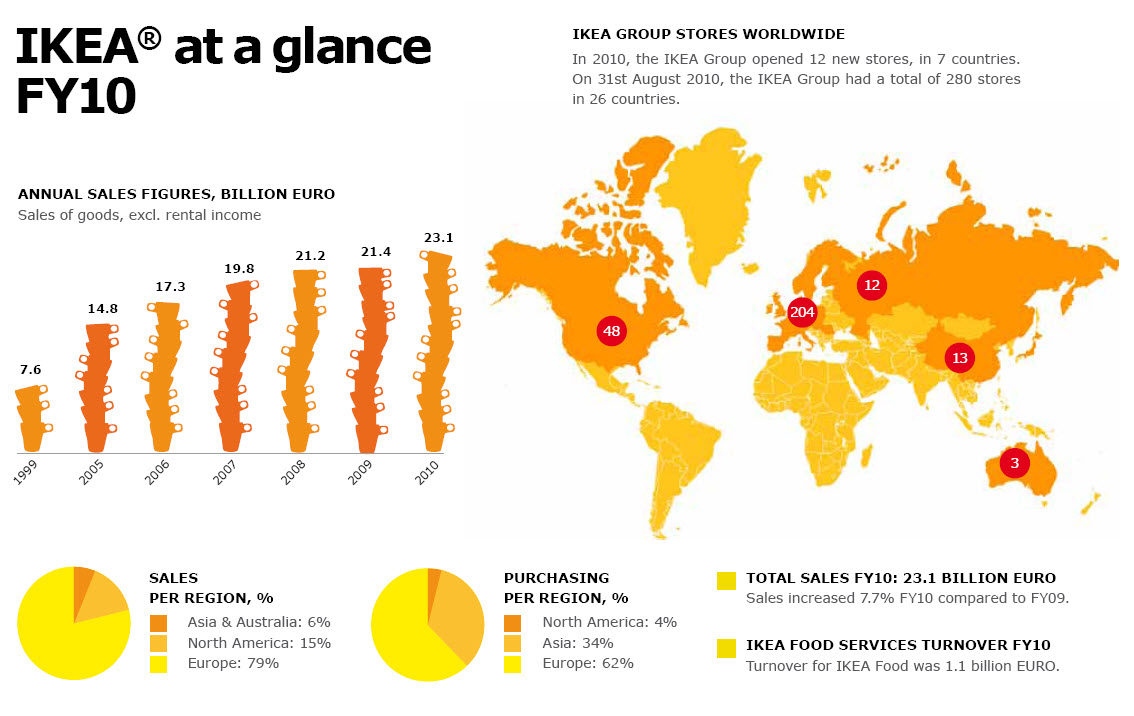

When last I checked the plot of corporate tax rates in the EU was:

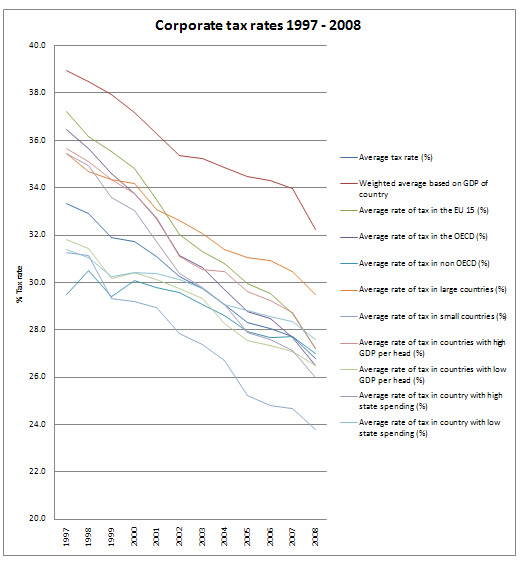

To prevent any doubt, a more complex analysis is as follows (all data based on KPMG information, with rates incidentally being largely fixed in 2009):

That’s a lot of data, but you get my point I hope — tax rates may be falling but something around 27% is the norm without weighting for GDP.

And yet IKEA has a tax rate of 13.1% in 2009 and 19.3% in 2008. We have no idea whether these are current rates either: if the provision includes deferred tax the current rate may be lower, but we can’t tell.

All we can wonder is why the published rate IKEA records is so low compared to the rates available in most countries in which IKEA must actually make its profit.Without country-by-country reporting we can’t answer that.

It is, of course, a reason why we need country-by-country reporting. Only when a company reports its sales, costs, profit and tax on a country-by-country reporting basis can be know that it is really paying its way where it should. I’m not saying IKEA isn’t. But I am saying the published data looks hard to reconcile with the rates data noted above, and country-by-country reporting data would let me resolve the conundrum.

I wonder if they’d like to republish on this basis?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

There is, of course, a lot to be said about IKEA’s tax arrangements – much of it is already recorded on the Wikipedia. The veracity of it would have to be checked, but the bizarre way that one piece of Ikea franchises its operations to another piece of itself is fairly visible.

It’s also worth considering exactly what they mean by “purchasing per region”: 34% in Asia might equate to 200 suppliers selling cheap stuff, while the 62% in Europe might be half a dozen suppliers supplying the high ticket stuff (that seems to be my experience of shopping in IKEA). By value it might be a European business; by quantity/volume it might not.

“IKEA is a private company”

You’ve been quite soft on them here Richard. Isn’t IKEA ultimately a “charity”?

@Noel Scoper

Ikea is a company

It happens to be owned by a charity

But these were trading results for a company

The ownership has no impact on the tax rate in hat case

Really? You must have missed the internet hoo-ha over IKEA’s structure then!

http://caps.fool.com/Blogs/how-ikea-manages-to-pay-almost/251411

@Noel Scoper

I’ve known all that for a ling time

All I’m saying is that the Ikea accounts do not expose why it’s tax rate is so low and how and they should, in my opinion

Of course the matters to which you refer may play a part in that – but this report does not say so

My point refers to this report alone and within that framework says the disclosure is inadequate, in my opinion

Do you have anything to add?

I think the point about its charitable status is valid. The fact that INGKA Foundation is a dutch organisation means that it doesn’t have to oublish accounts.

What concerns me is the extent to which it makes ‘management charges’ or ‘royalty charges’ to the main group. Certainly if it was UK based, we would know a great deal more.

I just reviewed the UK accounts for 2009, and note that it paid £13m in interest to group companies and only had a tax charge of £1.8m on a profit of £17m.

Interestingly, it has claimed exemption from disclosing related party transactions on the grounds that its group accounts are publically available.

If anyone wants to join me, I have just sent the following letter:

The Secretary

INGA Holding BV

C/O KVK

Water Molenlaan 1

PO Box 265

3440 AG Woerden

Dear Sir,

I understand from the publised accounts of IKEA Limited (registered in England and Wales) that the accounts of INGA Holding BV are publically available.

Please would you provide a copy of the latest consolidated financial statements to me at the address below. Please notify me if you require a payment in leiu of postage.

Kind regards,

Alex

If they dont send them, I will notify the financial reporting review panel that their UK accounts are in breach of FRS 8.

“If they dont send them, I will notify the financial reporting review panel that their UK accounts are in breach of FRS 8.”

Someone’s obviously got a lot of time on their hands!

This comment has been deleted. It failed the moderation policy noted here. http://www.taxresearch.org.uk/Blog/comments/. The editor’s decision on this matter is final.

This comment may have been libelous

Sorry Richard

@Keith Harris

You may find it funny Keith, but I am concerned about how much income taxes might be being avoided by the beneficial owner(s) of IKEA.

The charges made by the charity and the Luxembourg foundation appear to have run into the billions. Sweden is a small country. It has very comprehensive public services which ought to be paid for, by rich and poor alike.

@Alex S

Thanks for re-submitting

I have to consider such issues