![]() I was at a Smith Institute debate this morning, focusing on the budget. Several insights flowed from the debate, which was chaired by my Green New Deal colleague Larry Elliott and featured Chris Wales, onetime special adviser to Gordon Brown, plus Stephen Timms MP for Labour, Lord Newby for the Lib Dems, Kwasi Kwarteng MP for the Tories and Mike Devereux from the Oxford Centre for Business Taxation.

I was at a Smith Institute debate this morning, focusing on the budget. Several insights flowed from the debate, which was chaired by my Green New Deal colleague Larry Elliott and featured Chris Wales, onetime special adviser to Gordon Brown, plus Stephen Timms MP for Labour, Lord Newby for the Lib Dems, Kwasi Kwarteng MP for the Tories and Mike Devereux from the Oxford Centre for Business Taxation.

As I said during the discussion, what struck me was how closely I agreed with the comments made by Mike Devereux (yes, I did write that). What he, in essence, said was that the debate between the parties was largely inconsequential on deficit reduction. All parties say it has to be done; all say it has to be done reasonably soon, and all think a combination tax increases and spending cuts are essential. The difference between Labour’s preferred 65% cuts / 35% tax and the Tories 80% / 20% is 1% of GDP in reality according to Mike. And as he put it, candidly either way more than enough was being done to meet the requirements of the markets — if the promises are delivered.

And yet Mike, in making that comment walked round the elephant in the room — as did all others present in the debate. That elephant is the fact that this uniformity suggests there is remarkable agreement on the role government has to play in the current phase of this financial crisis. The implicit agreement is that it should exit the economy, stage right.

And this is what I fundamentally disagree with. I did, of course, say so. My point is simply this. People may (or may not) as Kwasi Kwarteng claimed intuitively think that government has been overspending and must rein back now, but this sentiment was more than adequately and accurately described long ago by Lord Keynes, who called it the paradox of thrift.

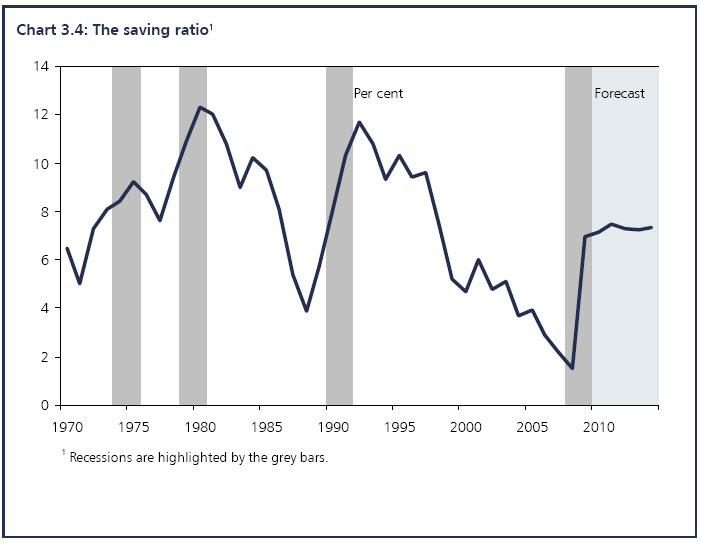

In essence, the instinctive reaction of households in the face of crisis, uncertainty and increasing debt is to scale back expenditure and to increase savings. That reaction is entirely rational, but it does, despite that rationality create the crisis we now see — to which none of the speakers referred. That crisis is that individuals are doing just what Keynes suggested they would do. They are saving more (even if that saving is evidenced by paying down their mortgage faster than strictly required whilst interest rates are low, because that qualifies as saving in these terms). This graph from the Office for Budget Responsibility shows it:

The UK household savings ratio has risen since the financial crisis developed, and is expected to stay high. That means people are not spending. That means there is a shortage of spending in the High Street. And that means companies will not invest. As Martin Wolf has pointed out the UK private sector savings surplus is running at something like $200 bn or £135bn a year as a result now (give or take is good enough here). This means, because these funds have remarkably little use elsewhere since all countries are all in the same boat right now, that these funds are being used to finance our own deficit, almost in its entirety, which is exactly why 90% of our debt is owned in the UK at this point in time.

In other words — the real macroeconomic issue of the moment — the one the whole panel ignored — and which the whole debate is ignoring - is the astonishing fact that we are quite able to fund our current scale of government spending and are doing so without difficulty — but the mechanism we are using to fund it is not called tax right now.

However, if we don’t want to call the current funding of the deficit tax — instead thinking of it as saving then the real debate is not about whether we need cuts — since it is apparent that the deficit is being funded and will continue to be funded for some time to come — but is instead how we actually use those funds we are choosing to lend to the government.

The Coalition plan is to spend that money on unemployment benefits since it is readily apparent that they want to put 1.5 million or more out of work and that the consequence will be a spiraling paradox of thrift with the result that we will move to depression from recession.

The alterative is that we make a very different choice. We could choose to spend that money on investment in our economy. We could do the Green New Deal — the only industrial strategy for the UK written in many a long year but the exact missing part of the equation that is required now.

The Tories presented a budget that assumes we want a small state. I guarantee that this sentiment in the country will change very rapidly and very soon when people realise what this really means. As one astute observer put it today, very few people in the UK realise just how dependent they and others are on state services and how much their absence will affect the quality of their lives — even if they still have a job.

I do not believe people want a small state. But equally I do not think we will get the state we want by hoping for it or by playing with some minor change to corporation tax rates or allowances. We will only get it by breaking the current epidemic of thrift that is ensuring we can pay for the deficit, but which is also going to be squandered on current expenditure which will provide no chance of paying a return on the debt.

An industrial policy will create jobs. It will stimulate the economy. It will send cash back into the private sector. It will encourage spending. It will recreate the tax base. It will reflate government revenues. It will close the deficit. It will create new jobs. If it’s a Green New Deal it will ensure we have enhanced energy security, so supporting the value of the pound as well as earning long term returns. And there will be jobs.

This is what macroeconomic policy is. Arguing about tax rates is little more than glorified micro.

Or to put it another way, the debate reminded me rather uncomfortably of the rather odd people who came to see me when I was a practicing accountant. They wanted advice on business structures and tax planning for their profits from the business they were about to start which was going to make mega-bucks. But when you asked them what it was going to do they didn’t know — they were going to get the structure right first, they said. That genuinely happened occasionally. And that is what economic debate is like in this country right now — focused on getting the structure right for business — but no one has the faintest idea what the business might be. Those potential clients who asked me those questions were destined to never make money. And the UK is destined to never get out of recession unless we know how we are going to earn the tax base which can restore government revenues.

George Osborne, Vince Cable and Alastair Darling have not addressed that key question. And they're also ignoring the glut of savings we currently have — which need a productive home. So, as Chris Wales said this morning, we need a discussion on how big the state should be (much bigger than the Tories think is the answer) and how we should pay for it (more tax is the answer) but first we have to get people working.

The lack of an industrial policy is the elephant in the room right now.

And I’m happy to offer the Green New Deal in the absence of alternatives.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Excellent! A breakthrough in terms of clarity for me in terms of why we can & must revive domestic investment.

We desperately need some economic activity to generate jobs and new wealth/tax receipts, but the government’s focus is on halting investment and killing off jobs.

We desperately need to address our energy security, stop wasting fossil fuels, and decarbonise the economy, but we are doing pretty much fuck all about it.

It doesn’t have to be this way.

Where are the Labour leadership candidates on the Green New Deal?

@Strategist

Thanks

Appreciated

sorry, Strategist, what do you mean by the words “decorbanise the economy”?

Richard, I’m worried about you. Yesterday you were agreeing with John Redwood. Today, Mike Devereux….

“The UK household savings ratio has risen since the financial crisis developed, and is expected to stay high. That means people are not spending.”

But surely, if the goal is – as I believe it should be – to move from a growth based to a sustainable economy, this is a good thing.

If people are paying down their debt and saving more for their retirement then surely that is a good thing.

If people are living within their means then that must be a good thing.

Surely the real problem is that our economy – and the tax receipts it generated – had been based almost entirely on wealth generated through financial services being recycled through the economy and spent on disposable trash: from binge drinking to 60 inch plasma screen TVs, weekends away in Eastern Europe to pay per view sport on TV, designer clothes and celebrity endorsed fragrence.

Isn’t the truth that we need to completely re-orient society towards the local, the sustainable, the meaningful? We need to educate people away from the cults of celebrity and advertising. And while public spending may have a role in making sure the economy doesn’t falter further, isn’t the real truth that to achieve a sustainable economy and a sustainable future we need something far more radical than simply trying to prop up the economy until public confidence returns and we go back to business as usual?

@James from Durham

I’ll go and lie down!

The elephant in your assumptions. Do people want a small state? It is clear that you don’t, but I would suggest that that is not sufficient empirical data to support your claim. Actually that is not the “howler”. What makes you think the coalition are following a smaller state policy? It seems clear from the start of your analysis that neither the coalition nor the labour party are in fact going down that route – you even appear to agree. So why cloud your stance in fiscal policy with a political polemeic that is of no relevance?

@alastair

Tory and Lib Dem MPs tell me they’re going down that route

What do you know they don’t?

And doesn’t opinion matter any more?

It seems only logical positivism is now allowed. Am I right?

People are saving because they’re frightened, not because they want to !

While the [various] governments and hangers-on may say we have to slash spending, they have nothing to put in its place to replace the work government gives to people.

When we have slashed spending, have another 1 million plus on the dole, what then ?

Industry isn’t going to expand, it is more likely to contract and emigrate.

Personally I believe the people I know: worse is to come, batten-down the hatches !

[…] is, I suggest, happening again. Private enterprise has no clue how to generate wealth right now. I mentioned the consequence a while ago. Private business has no idea what to invest in now, no new product to make, no big […]

[…] is, I suggest, happening again. Private enterprise has no clue how to generate wealth right now. I mentioned the consequence a while ago. Private business has no idea what to invest in now, no new product to make, no big […]