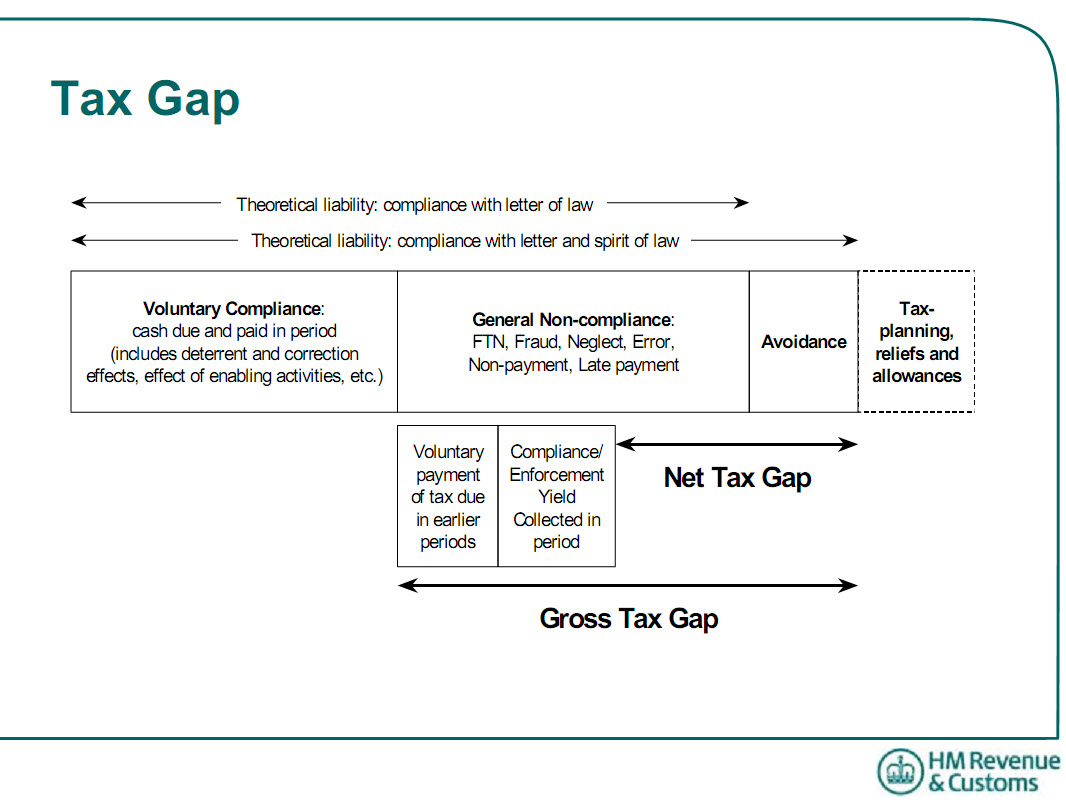

Tax Research agrees with the definition of the Tax Gap produced by the Large Business Services of HM Revenue & Customs in 2005, reproduced diagrammatically, below.

Tax Research UK therefore considers, as does HM Revenue & Customs, that tax avoidance is part of the tax gap. This perception is based on the fact that voluntary tax compliance and fair tax planning are both part of tax compliance which is defined as seeking to pay the right amount of tax (but no more) in the right place at the right time where right means that the economic substance of the transactions undertaken coincides with the place and form in which they are reported for taxation purposes.

The tax gap is defined as, consistent with the above diagram, having three major components:

1. Tax lost to tax avoidance, which is defined here as seeking to minimise a tax bill without deliberate deception (which would be tax evasion or fraud) but contrary to the spirit of the law;

2. Tax lost to tax evasion, which is the illegal nonpayment or under-payment of taxes, usually by making a false declaration or no declaration to tax authorities, resulting in legal penalties if the perpetrator is caught;

3. Nonpayment of tax declared to be due, i.e. late payment or bad debt suffered by HM Revenue & Customs.

The first of these is also defined as avoidance by HM Revenue & Customs in their diagrammatic explanation of the tax gap (no longer available on the web):

The second and third are defined by HM Revenue & Customs as general non-compliance.

Together they are the tax gap.

Together it is currently estimated by Tax Research UK that they come to a sum of £120 billion.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The issue of “spirit of the law” ultimately depends on which protagonists view you are listening to and is interpretive. What the Revenue regard as contrary to the spirit of the law may quite justifiably be regarded as within the spirit of the law by the taxpayer.

The tax case law is littered with examples of where the Revenue may be accused of acting contrary to the spirit of the law. One man’s acting within the spirit is another’s acting outside the spirit.

Jaypee – It’s a valid point. The spirit of the law is pretty vague, which is why mature democracies try to stick to the letter of the law.

Perhaps, Richard, you could clarify what you see as legitimate avoidance and where the line of illegitimate avoidance lies.

@Charles

Tax compliance is legal.

Tax compliance is defined as seeking to pay the right amount of tax (but no more) in the right place at the right time where right means that the economic substance of the transactions undertaken coincides with the place and form in which they are reported for taxation purposes.

Using allowances for another purpose is avodiance