![]()

The Economics of Ignorance is widespread. It is what is fuelling wholly politically motivated demand for cuts in our economy.

The economics of ignorance is class warfare: the desire of the ‘haves’ to claim more from the ‘have-nots’. It is not economics as such at all.

However, the most astonishingly spurious claims are put out in support of it. take these from Andrew Lilico, the chief ‘economist’ of Tory think-tank The Policy Exchange, writing in the Observer this weekend:

We should cut early, as deep as is feasible given time-tabling constraints. We need growth, and early cuts are likely to promote growth, even in the short term. There are three reasons why.

First, at lower levels of public spending the economy is likely to grow faster. If the economy grows faster, then wages will grow faster. So households today will feel safe to borrow and consume more and to save less, knowing that their (pre-tax) incomes will be higher later, allowing them to pay off their debts. Investors will also expect better returns if growth is faster.

Next, if we cut spending early, households will be more confident that the UK's huge deficit — about £160bn, or 11% of GDP — will be addressed mainly through spending cuts rather than tax rises. Becoming more confident that their taxes will not go up, households' expectations of their post-tax incomes will rise, again allowing them to borrow and consume more and save less today.

Third (and less important, unless matters go badly), when deficits are very high financial markets may become concerned that governments will default or inflate to escape their debts. This fear means that the interest rates paid on government debt rise, raising the price of borrowing across the economy. The effects can be very large — if sustained for any length of time, a deficit of 11% of GDP could add 2% or more to interest rates, costing households many hundreds of pounds per year. Cutting spending to cut the deficit should allay these fears, allowing interest rates to stay low.

Let me deal with all three arguments in turn.

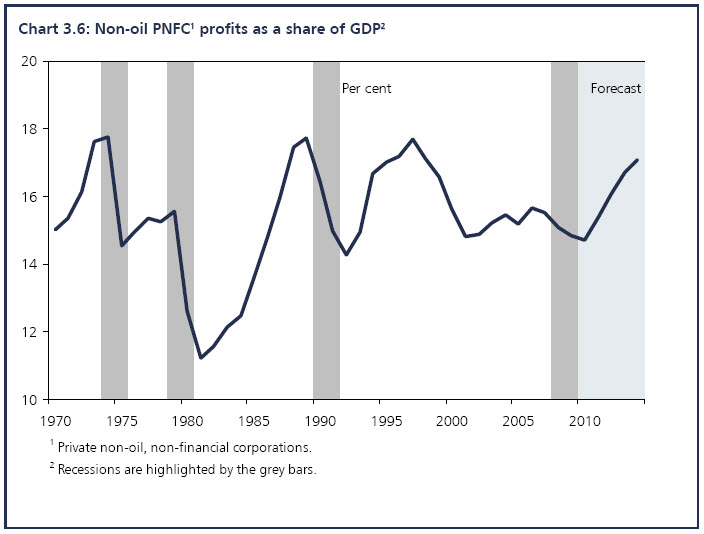

The first argument is not an argument at all: it is a statement of faith. It is also a statement of faith not supported by any facts. First of all, whether opponents now like to recognise it or not, the longest period of sustained growth in the UK came under the Labour government from 1997 until the onset of the crash. That did not happen because of reducing government spending: as we all know government spending rose. But so too did profits. As a share of GDP they looked like this:

Profits, which no doubt Mr Lilico would say drive growth fell when state spending was tight from 1995 to 2000, and just into the recession that followed. Then they rose, and sharply in absolute terms as GDP was also rising significantly. In other words profits rise when state spending rises, not vice versa. Cutting state spending now is likely to reduce profits, that’s what the evidence says. There’s little sign of growth there.

Nor is it likely as Larry Elliott as pointed out:

The budget hawks like to cite Geoffrey Howe’s draconian 1981 budget as evidence that fiscal tightening is perfectly consistent with economic growth. So it is, providing there is scope for an over-valued pound to depreciate and for excessively high interest rates to be cut. So it is, provided that tumbling oil prices raise the real incomes of consumers and cut costs for businesses. All these things happened in the early 1980s; none of them are likely to occur now. The pound has already fallen by 25%, interest rates are at 0.5% and oil prices show no sign of falling much below $70 (£48) a barrel.

In other words: there is no prospect of this happening.

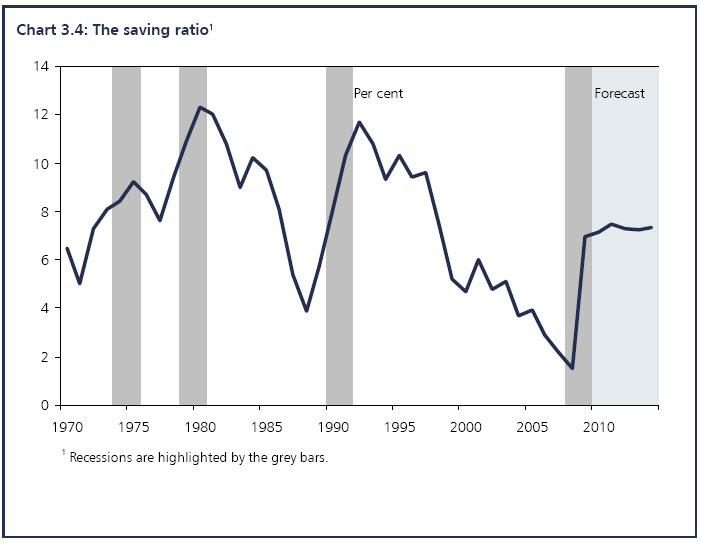

But there is another quite fundamental reason why people will not react as Lilico suggests they will: if state spending falls state provision falls. If state provision falls the safety net the state provides falls. If the safety net is reduced then the savings people have to make to cover the risk previously assumed by the state increases. That follows like night does day. It’s exactly why it is assumed in the Office for Budget Responsibility reoport that savings ratios will remain high:

No sign the OBR thinks people will be going out spending there: far from it in fact. they’re saying they’ll behave as I predict. And that does not drive growth. In other words, even the OBR think Lilico’s claim is shot through.

The second claim can be dismissed for the same reason. let me give a very personal anecdote. My wife might one day receive an earnings related state pension as a result of her work for the NHS. In this household, as I suspect in every other one of the 6 million households where those pensions are under threat we’re now discussing whether we should try to increase savings to compensate for the fact that state spending cuts are designed to impose a greater cost on us — even though she and her employer have made substantial pension contributions to date.

Add to that the fear that people will no longer be paid when unemployed or sick — and cuts in both benefits are likely — and rational people will in the face of spending cuts save, not spend. If they fear interest rates will rise as well, as they might given this government's wish to talk down the pound and so fuel inflation, then they’ll do the same by seeking to pay off their mortgages.

The simple truth is when insurance is removed people save. That’s what the government intends to do. Growth will fall, not increase as a result.

So let’s deal with the third suggestion. A Paul Krugman put it:

In short: the demand for immediate austerity is based on the assertion that markets will demand such austerity in the future, even though they shouldn’t, and show no sign of making any such demand now; and that if markets do lose faith in us, self-flagellation would restore that faith, even though that hasn’t actually worked anywhere else.

And this, ladies and gentlemen, is what passes for respectable policy analysis.

Why does he say this? Because there is no sign whatsoever that there is any shortage of willing lenders to government — those households doing all that saving noted above being a major component of the supply of buyers. 90% of UK debt is home owned.

In other words, the entire argument for austerity is based on a myth. A myth that the likes of Policy Exchange promote.

It’s not just bad economics: it’s the economics of ignorance — which is not economics at all.

But it is outright class warfare as the rich seek to capture the state for their own benefit.

And that is why it has to be opposed.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I think to be fair to the Observer, Lilico’s article appeared as one of several pieces in a pros vs cons page headed ‘Economic Crisis’. As well as Lilico, those great luminaries John Redwood and Ruth Lea were there supporting cuts (what a surprise) and John Eatwell acted as the voice of reason.

When I read Mr Lilico’s unsupported claim that ‘at lower levels of public spending the economy is likely to grow faster’, my first reaction was to echo Private Eye’s Glenda Slagg — crazy name, crazy guy. But than I thought is he (a) just extremely stupid – but no, surely even Policy Exchange could get someone better, things being as they are, or (b) a PR man, an empty sloganeer — but then again not very good, or (c) someone so trapped in his own hermetic little mind set that he cannot see that statements that seem obvious to him are in fact questionable and problematic. I presume (c). To the charitable, an object of pity, perhaps.

Mr L’s arguments — or should I say — assertions are merely a reflection of the same old Say’s Law / there is no such thing as involuntary unemployment / Ricardian equivalence etc. etc. mantras that have led to so much waste and suffering over the last two centuries. It looks as if there may be struggles ahead — and one of our main struggles must surely be intellectual – of exposing these doctrines whenever they raise their heads for the empty shams that they are. Thank you for your sterling work in this regard, Mr Murphy.

If you’re saying the longest sustained growth (which started 5 years before Labour took office, incidentally) occurred during an era when government spending rose, you also have to concede that the largest economic crash since the war also coincided with a huge increase in government spending.

[…] I noted yesterday, the deficit hawks claim that: at lower levels of public spending the economy is likely to grow […]

@Nick

Chicken and egg appears to be your problem

Of course spending rose

That was because of the recession

It did not cause it

Three questions spring immediately to mind.

Isn’t a piece of he plumbing missing? The money flowing into the exchequer. Where did that come from? PNFC or oil and finance?

And did you leave in profits from housing? There are a lot of people who haven’t ‘worked’ in years because they are living off various games involving buying and selling houses.

And what about the 25% of people who are barely economically active? How much did the formula of the last decade create a vibrant economy where individuals are able to hold their heads high?

@Jo Jordan

I think you miss the point of the graphs

These are shares of GDP – not government revenue

I think I got that.

Your overall argument is that the economy was healthy. The broad (unsophisticated)counter-argument is that the economic growth was based on ‘funny money.’ Non-oil and non-finance (including or not including residential property games) might have been booming, but why? Was it sustainable or was it simply some sophisticated QE (money printing in plain English).

The question the people who don’t instinctively believe you want answered is this: Where is the economy?

All of the above is crudely put but it is the crude interpretations you wish to counter, not so? The questions I ask are the questions people ask and don’t get answered – at least not all at once in one coherent narrative.

You say profits rose from 1997 to the crash.

But looking at chart 3.6 the profits fall, from 17ish to 15ish percent of GDP. Am I missing something?

Also, the period of the 1970s and 1980s is really startling. The high-tax 1970s saw a catastrophic fall in profit levels. The 1980s, when taxes were cut, saw a sky-rocket recovery. Thoughts?

@Jo Jordan

I genuinely wish I understood your question

But I’m not sure I do

Can you try again?

@Charles

Hang on. Try oil as the cause of the fall in 1973

Try Thatcher as the cause in 1980 when profits crashed

And if the Tories delivered profit from low tax why did that not work in the early 1990s?

I really think you’re looking at wrong causal links here

Tax is not as important as you think – but a long, long way

I was trying to show you why I was asking, or rather shouldn’t be dismissed with a wave of the hand.

My factual interest are in the first three questions

1. What funded the state spending (that funded the PNFC boom)?

2. Do the PNFC figures exclude the massive amount of (pseudo) economic activity of buying and renting second homes, flogging parental homes, etc.? (Have the figures been partitioned?)

3. How do we counter the argument that an unknown proportion of the UK population (guessestimate of around 25%) does not have an economic role other than to live off effective subsidies (what a conservative politician described as the modern day workhouse)? Where are the dynamic engines of economic growth that a young Brit should gravitate towards?

These are all ‘questions of information’ – points I would want to clarify to understand your argument as a whole.

Richard – “Try Thatcher as the cause in 1980 when profits crashed”.

The chart 3.6 shows profits rose in the 1980s.

@Charles

Only after the initial crash she caused

And note they crashed again at the end of the era

My point stands, I think

“Only after the initial crash she caused”. Eh?

Are you suggesting Thatcher was reponsible for the final drop in profits from 1979 to 1981 – a continuation of a near decade long trend? She caused that crash?

Your assertion that profits crashed in the 1980s, well, it just wrong surely. Profits clearly rose steeply.

The Nineties also don’t support your theory.

Profits are higher in Nineties than the decade which followed. The chart shows that pretty clearly. During the middle of the 1990s there they even near 18 per cent – a massive high.

Personally I can’t see a correlation. There are too many other factors to consider. You, on other hand, make the claim: “profits rise when state spending rises, not vice versa. Cutting state spending now is likely to reduce profits, that’s what the evidence says”.

Purely on the evidence of chart 3.6 this is false. If anything, this chart shows an inverse relationship.

@Charles

Charles I see a pattern that follows boom and bust

Not tax

Let’s agree to differ

@Jo Jordan

The state spending came out of growth in tax revenues – and modest borrowing – ratios were under 40% of GDP

No PNFC does not include capital gains. These are not as such in GDP. They are transfers of value – not new value

Where’s growth – where the consumer is! Green, new tech, festival wear I’d say

Seriously – if I wanted to direct someone now I’d say look at green tech

I wonder how much of GDP was fueled by the income arising from the property market – it would be counted once it is spent of course?

I think what you’ve said is what I feared (as someone temperamentally left of centre) and what most Conservatives believe they know – that the boom was illusionary. There is little evidence that the economic capacity of UK even held constant in the last 15 years?

@Jo Jordan

I would say that GDP growth was fuelled by credit expansion, backed by land as collateral (as ever). Right at the beginning of Brown’s reign at the Treasury it was recognised that the British obsession with landed property was a problem (one of the reasons why we didn’t adopt the Euro). They believed that the only tool they had to curb house price inflation was interest rates. Whether because it was not within the remit of the BoE monetary committee to raise interest rates when the general rate of inflation did not merit it, or whether Brown did not want to reverse GDP growth, no action was taken and house prices roared away.

Very few economists understand the role that land plays in the economy and those that do continue to be ignored. Collection of all land rent for public benefit is the very simple (but apparently politically infeasible) solution.

It seems to be as I naively thought. (I lived in NZ for a while and the slack in the economy seemed to rest on manipulating land prices largely by stimulating migration.)

I am a psychologist so I am more interested in what action individuals can take to define satisfactory economic roles for themselves. Since I start reading “left” economists, I am afraid I more and more see what conservative economists are saying. I might not like their values but I can see what they see in the data. It’s a pity that a lot more was not done in good times to focus on competitiveness. But maybe it was done and the starting point was much lower than I imagine!