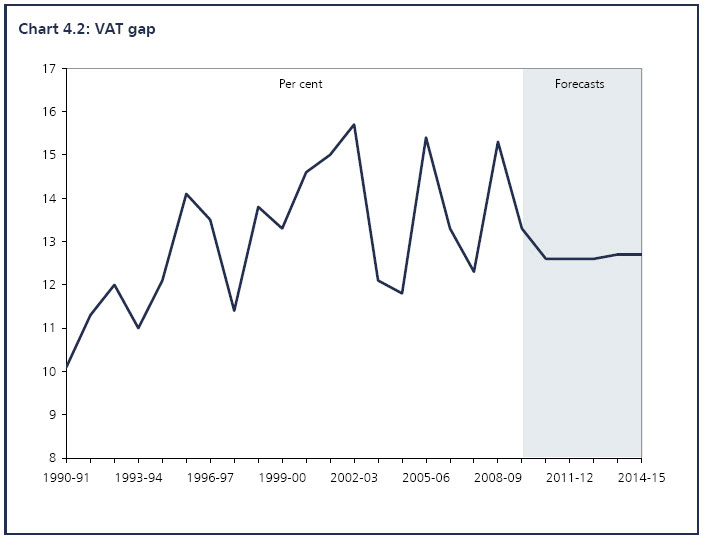

The Office for Budget Responsibility’s first report continues to provide amusement at the breadth of its gall. Take this on the VAT gap:

The judgement about the VAT gap is a critical element of the VAT forecast. The VAT gap is the difference between the theoretical level of VAT liability and actual receipts. It can be ascribed

to error, avoidance, evasion, MTIC5 and VAT debt. The approach we have taken is to assume a constant percentage level for the underlying VAT gap over the forecast period after adjusting for

the expected effect of changes in VAT debt in 2010-11.

What does this mean in practice? Look at this graph:

It’s great isn’t it?

The average has been oscillating wildly around a figure above 14% per annum total tax gap but let’s assume it will be somewhat below 13% in future.

I wouldn’t mind bar two things. First that assumes collection of maybe £9bn extra a year some years, and that’s just speculative thinking without nay foundation. Second, this is being assumed without allocating any resources to actually deal with the issue, and that makes no sense at all.

In other words, this is pig in a poke stuff.

And I thought the OBR was meant to be getting rid of that? Time to pull the other one, I think.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: