‘Slash the tax’ - Accountancy Age.

My friends down at Oxford University ran an event recently on controlled foreign company rules, but it looked as though it was hijacked so that they can state the naked aim of the so called Centre for Business Taxation at the Said Business School.

As Accountancy Age reports about the event:

Finance chiefs at two of the UK’s most powerful companies have called for corporation tax to be slashed to 15% in what would represent one of the most sweeping changes to the UK tax system since VAT was introduced 30 years ago.

As more and more business giants turn their backs on the UK or threaten to move offshore, Julian Heslop, chief financial officer of GlaxoSmithKline, and John Connors, tax strategy director at Vodafone, laid down the gauntlet to the Treasury and pushed for the tax to be almost halved. They believe this would give the UK a dual boost, stemming the flow of companies leaving the UK while also attracting overseas investment.

How do I know 15% corporation tax is the aim of the Oxford Centre? because Chris Wales - who was instrumental in setting it up - told me that was the case, in person when I was t Oxford two or three years ago before Prof Mike Devereux, the head of the centre, contrary to all UK academic ethics, withdrew my invitation to all events there.

And let's be clear what this call is. It's another blatant attempt at re-engineering the social structure of the UK so that the rich get richer and the rest fall further behind.

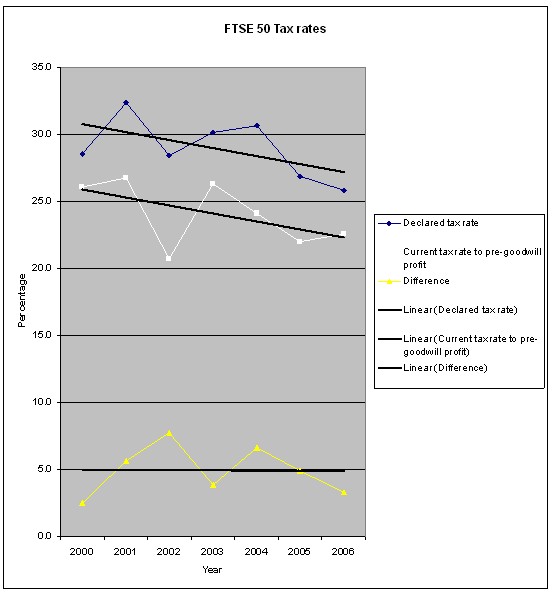

I know all the twaddle Devereux, Jim Hines and other aficionados of so called free markets that are anything but free put forward about corporation tax being a tax on labour. And I've also shown they are wrong. The data I prepared on trends in corporation tax in the UK from 2000 to 2006 based on detailed analysis of tax paid by the largest 50 UK companies in that period, published in the Missing Billions in 2008 showed this:

The effective rates of corporation tax in the UK fell during this period from 26.1% to 22.5%.

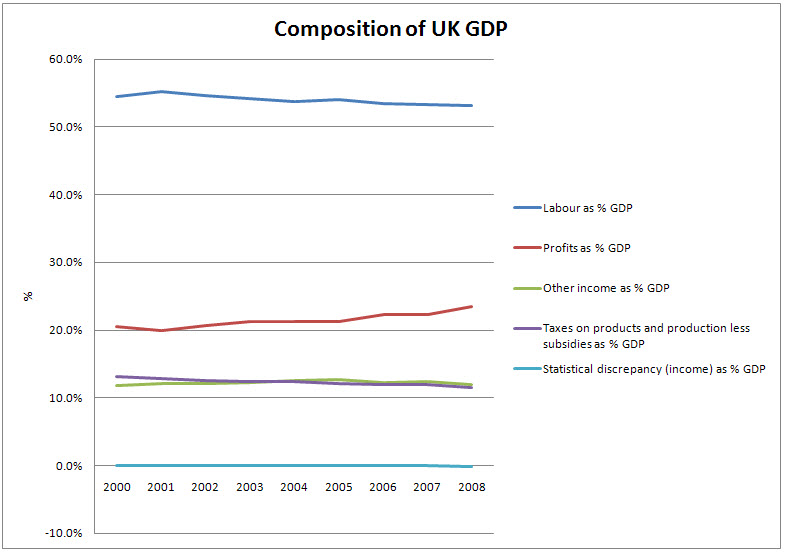

If Devereux at al are right wages should have risen as a result. This graph is based on direct download of Office for National Statistics data and shows what actually happened:

From a high of 55.2% labour share of GDP in 2001 it fell to 53.2% in 2008. The return to capital, however, rose from 19.9% in 2001 to 23.5% in 2008.

Glaxo and Vodafone and their friends at Oxford want to increase the gap between rich and poor in this country. It's the only explanation for their proposal there is.

And it's sickening.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Not sure that I agree with you on this one Richard.

I think the idea that is being proposed is a rate cut that is funded by removing a lot of the current legislation that gives companies and groups extra or accelerated deductions. One of the key issues in UK tax is the sheer complexity of the legislation. Companies would willingly give up statutory deductions allowed by UK law for a significant reduction in complexity. You have no idea how expensive and time consuming it is to comply with UK tax legislation and put together a UK corporation tax computation for any group with extensive operations. When you add in international operations, the complexity multiplies significantly.

In my view (and I admit I haven’t undertaken the research that you have here), a rate cut together with a removal of most (if not) all the extra deductions would raise more revenue for the Exchequer. Groups would be more willing to locate significant operations in the UK (including high value manufacturing operations which this country sadly lacks) which would then generate revenue and wealth through new employment and additional economic activity. The reason for this is that the rationale for avoidance/planning (call it what you will) is removed.

@Richard

Overall the UK average tax rate was about 22% when last I reviewed it

There is no way a 15% headline could make it more

I’m afraid to say I don’t believe that the reliefs and allowances will go either

What I actually think is being argued for here is “trickle down” – give us tax breaks and we’ll bring the money it which will maintain all the poor people in your country

It’s never worked

It never will work

And yes I do think tax simplification is essential – bit the overall rate needs to significantly increase as a result

And no one will leave

They say they will – but they don’t

Those who have said they’ve left to date a) hardly paid tax and b) are open to serious challenge anyway

So this is just money grabbing

Let’s not offer any more excuses for it

Richard

The problem with Corporation Tax is that it is taxed on profit. Unfortunately profit is not an objective enough quantity to prevent the tax on it being reduced by various avoidance measures. It is also impossible to definitively link any company’s tax or profit to its operations in any specific country, or to any individual subsidiary. So why not try a different approach? Tax turnover, not profit. After all, individuals are taxed on income, not profit, so why shouldn’t companies?

If most companies average profits of about 10% on turnover, and are supposed to be taxed at 28% on their profit, that effectively equates to a tax on turnover of about 3%. Yet most companies pay much less than this, or even nothing at all. So why not split the tax between turnover and profit?

I pointed out on an earlier thread that we should change company law so that all UK companies should be classed as either:

(i) a parent or holding company owned only by individuals, or publicly quoted on the stock market;

or

(ii) a subsidiary company that could not itself own any other company (or a part of one).

This, I argued, would make secrecy issues over accounts and ownership impossible as in any given UK corporate organisation either the parent, or the subsidiary, would be in the UK . Therefore each would have direct knowledge of the ownership and financial structure of the other part of the company. I now also believe it could make tax avoidance impossible as well.

The advantage of taxing a UK company on its UK turnover is that it cannot avoid it any more than it can avoid VAT or NICs. So we should tax all UK subsidiaries on their UK turnover at say 1%. Service companies that need to operate in the UK would be unable to avoid this tax as they could not move overseas without a total loss of revenue and profit. They need to be where their customers are. Manufacturers might relocate to avoid it, so could be given exemptions or rebates on all turnover that they get from overseas, thus boosting exports.

Then we could tax the UK registered parent company on its profit at 10% or 15%. A company that had no subsidiaries or parent would then be deemed to be both, and so would be liable to both taxes.

The advantage of this would be that subsidiaries and simple UK companies would be unable to relocate to avoid the turnover tax, while UK-based parent or holding companies would have little incentive to do so as they would be taxed only on their global profits at a low rate of 10% or 15%. It would also mean that companies bought with debt could not avoid tax as the debt would not be offset against turnover. This would therefore reduce the profitability of takeovers and private equity buy-outs.

Any thoughts Richard?

Corporate taxation is all about international coordination, without which we end up in an unwanted Nash-equilibrium with a lower tax take (and an unwanted burden on the production function labour). More on this in some papers here: http://ec.europa.eu/taxation_customs/taxation/gen_info/tax_conferences/tax_forum/article_6720_en.htm .

Unfortunately, the UK is one of the main opponents to tax cooperation.