Any quoted company has to file accounts that include a tax reconciliation statement.

The statement is meant to explain the difference between the tax rate in the accounts and the statutory tax rate.

RBS has admitted tax avoidance of £500 million today.

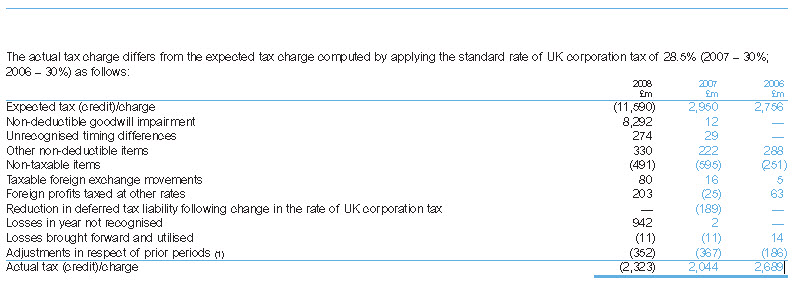

This is its tax reconciliation statement in its 2008 accounts:

The only line in there where this could hide would be ‘non taxable items’. They’re a credit — the only one there is year in year out.

Is that good enough?

If this is where the tax avoidance is hidden is that a set of accounts really giving a true and fair view?

I’ll say this to Deloitte LLP: this is ‘just rubbish’.

And I now have the satisfaction of knowing I’m right and Deloitte LLP is wrong.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] are trying to recast something that hasn’t worked without fixing the problems. For example, Richard Murphy has finally been vindicated in his assertion that the UK banks (at the very least) have been actively engaged in high stakes […]