I missed a letter in the FT last week from Lord Wallace of Saltaire, the Lib Dem peer and former LSE academic. He said (and I have edited a little):

The "anger and alarm" from British-based multinationals you report ("Darling in U-turn on foreign profits tax", July 21) concerning Treasury proposals for corporate taxation should not obscure the real problem the Treasury is attempting to address: the erosion of the national tax base through offshore tax planning by multinationals.

You quote Angus Russell, Shire chief executive, claiming at the same time to want Shire "to be a good corporate citizen" and "to provide the most efficient tax structure for my shareholders" (report, July 20). It is not easy to reconcile these divergent objectives. ....

Governments of advanced democracies face the unwelcome choice of further reducing taxes on companies, depending for their revenues more and more heavily on consumer taxation - and personal income tax on those who cannot claim to live across national borders - or of limiting the autonomy of offshore financial centres and negotiating tighter international rules for corporate taxation. The CBI, the Engineering Employers' Federation, the pharmaceutical companies as a group, would do well to offer a constructive response to the erosion of the national tax base, before some populist politician or press campaigner seizes on the issue to use against them.

William Wallace,

House of Lords

Martin Temple of the Engineering Employer's Federation responded saying (again, in part):

Lord Wallace's concerns about the tax base are understandable, but misplaced.

In a globalised economy where manufacturing investment is mobile, the UK needs to learn to live with the realities of tax competition. The competitiveness of our tax system is due partly to rates but also to clarity of policy, simplicity and relationships with business. We therefore believe the current focus on anti-avoidance and protecting the tax base too often comes at the price of a competitive business environment.

What Lord Wallace misses, and what the government must recognise, is that the most significant threat to the UK's tax base does not come from aggressive corporate tax avoidance but from the revenue lost owing to companies moving abroad in search of greater consistency and certainty from the tax system.

Repeated changes to rates, rules and allowances have created the impression that there is no proper, consistent strategy on business taxation in the UK. The rational response from business has been to reconsider its position in the UK.

Vanessa Houlder has since published a discussion piece in the FT referring to both letters, but without reaching apparent conclusion.

Yet there is a conclusion to be had. First, it is important to note that the companies leaving the UK so far have paid almost no tax here. Second, it's important to note that many of those that might leave in future will also pay almost no tax here. Vodafone is a good example, and is referred to by Vanessa Houlder in her article. This is the inevitable consequence of the misconception that a company listing in London is based in the UK. Third, the UK should not be taxing foreign profits in the UK if they are really foreign profits: we should be encouraging their taxation elsewhere.

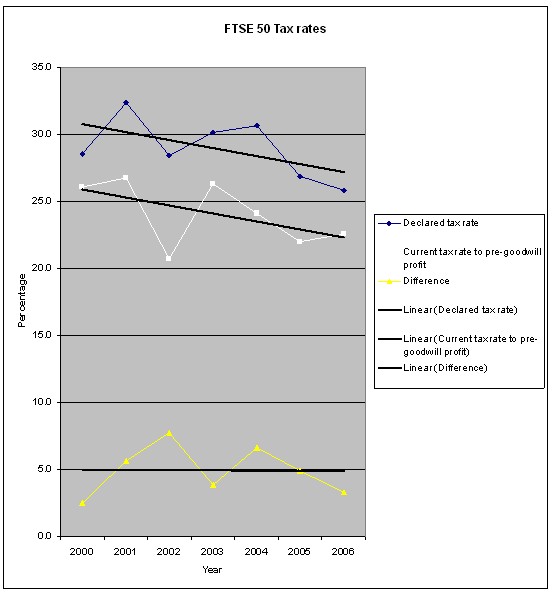

But fourth, and most important, Martin Temple seriously misses the point. What is consistent is corporation's absolute determination to avoid their obligation to pay tax in the UK. This is shown by this graph of effective corporation tax rates, based on my own research based upon the FTSE 50s accounts:

Any responsible government has in the face of such a concerted attack to take action to defend their revenue. To do so is nothing more or less than good internal control and that is a key element in any sound governance regime. As such, Martin Temple is looking at the wrong source of inconsistency in taxation policy. That source is embedded in corporate behaviour.

But what is also wrong is the government's belief that this can be corrected by tinkering with the existing corporation tax regime. That will not be possible. The regime that we now have is premised on these things:

1) That the corporate entity is taxed, and the group of which it is a member is ignored;

2) That legal form has priority over economic substance;

3) That accounting profits are a reliable basis the taxation;

4) That the free movement of capital is both desirable and beneficial;

5) That corporate taxation is nationally based but that no country will assist another to collect the taxation revenues due to it;

6) That there is sufficient information available on calculate the appropriate taxation charge.

I suspect that this is a list that I can develop further but the point is this: these assumptions are now either inappropriate or simply do not hold true. Martin Temple would wish that they continue in use and his call for consistency is a plea for no interference with them. Lord Wallace recognises the implausibility of these assumptions and the impossibility of their continued use as the basis for corporate taxation. In that case he calls upon business to be part of the process of reform that recognises the obligation of all to contribute to the society from which they benefit. As such it is absolutely clear that it is his letter and his argument that has not just the moral high ground but the clear force of logic behind it, and his call is therefore one to which business must respond or have a system imposed upon it.

Martin Temple would be wise to note what is happening in America: the UK might not as yet be reacting as American politicians are to the threat from offshore but there are politicians who are aware of the risks that it poses and who know that action can be taken to stop the abuse.

I do admit though: the threat from offshore and from corporate relocation can not be managed within the current structure of corporation tax, simply because the assumptions upon which it has been based no longer hold true. That is why a more thorough review of the future of that tax is essential, and is why that review cannot be left to tax experts and their corporate clients alone.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] sick that tax havens and corporation tax abuse are premised on the free movement of capital when we condemn people to eating mud cakes by denying their free movement. That too contributes to […]

Re the Vanessa Houlder article, I liked the comment from Jeffrey Owens (arguing that turning a blind eye to international tax avoidance is tantamount to stimulating growth at any price): “The same logic could be applied to business run by the Mafia or Colombian drug dealers.”