Vanessa Houlder has picked up the theme of the Tax Gap in the FT this morning. As she notes:

Britons hiding money in tax havens have evaded up to £1.5bn of tax a year, according to the first official estimate of the "tax gap".

Picking up on a new paper from HM Revenue & Customs she notes that:

Most of the £80bn that Revenue & Customs believes was stashed offshore in 2005 was held in the Channel Islands and the Isle of Man, says a research paper on the difference between the tax Revenue & Customs collects and ought to collect.

Switzerland was the next most important destination for undeclared funds, followed by the Cayman Islands, Singapore, Hong Kong and the Bahamas.

The tax gap - the result of both avoidance and evasion - was estimated at between £11bn and £41bn, compared with total 2003-04 revenues from direct tax and national insurance of £246bn.

But look at some of these other stats that the Revenue notes:

- 51% of all self employed people and partnerships are tax non-compliant

- 40% of small employers are non-compliant

- 20% of the non self employed wealthy are non-compliant

- 20% of all inheritance tax returns are non-compliant

- 20% of stamp duty returns are non-compliant

Most of these will have had support from accountants in preparing those non-compliant returns. But those accountants apparently don't see any of this non-compliance. Why is that?

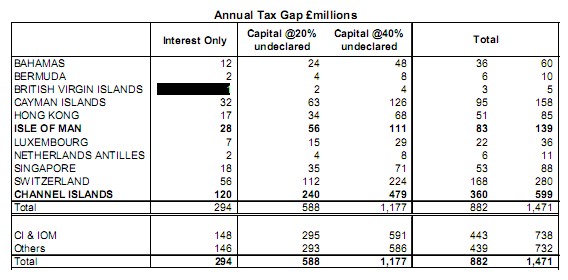

These rates of abuse are staggering. But so are those offshore. HM Revenue & Customs produce this table:

As they then say:

Therefore our estimate of annual loss of tax through evasion using offshore bank accounts is between £0.9bn and 1.5bn.

And as they also note:

Most of the use of offshore accounts for evading tax is thought to lie with the self-employed and company directors.

Which, as I'd remind my regular readers in the tax havens, means that most of the money you're holding for UK customers is tax evaded and so money laundered, which means you are on notice that you need to report it to your financial services authorities or risk being guilty of a criminal action in your own right.

And let's be clear what the names of the banks who hold these funds are. They're not obscure unknowns. You should instead be thinking of names like Barclays, Lloyds, RBS, HSBC. Those pillars of respectability within our society are the places where at least some of this money is hidden. The 2007 tax amnesty proved that. Yet not one of them reported a single suspicion of criminal money laundering, which is what tax evasion is, in Jersey in 2006.

Amazing isn't it? And quite impossible to justify.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: