The Observer has noted today that:

Northern Rock's accountant PricewaterhouseCoopers is facing accusations of a damaging conflict of interest after it emerged that it earned bigger fees for helping the crisis-hit lender to sell on its loans, and borrow funds in the wholesale markets, than for auditing the business.

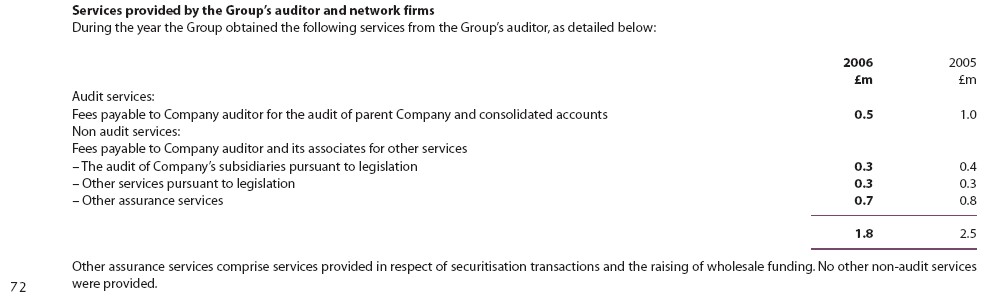

The bank's annual report reveals that PwC was paid £500,000 in 2006 for auditing and £700,000 in 'non-audit fees', specifically 'in respect of securitisation transactions and the raising of wholesale funding'.

Just in case there's doubt, this is what the financial statement reports:

These services do, of course, relate to the Granite companies about which I have written on this blog.

Vince Cable for the Liberal Democrats said:

This appears to be a serious conflict of interest. I would worry about the fact that the auditor appears to be making enormous fees from what turned out to be the most disastrous aspects of the Northern Rock situation.

My comment was perhaps more robust:

It's a complete conflict of interest: it's absolutely absurd. Once they've endorsed these structures, for the purposes of raising the money, they can't turn around and say, this is no good for the purposes of an audit.

This is obvious, surely: there is no way that you can both report on the Granite prospectus (as PWC did, and for which no doubt these fees were paid) and then only a short time later when some of the debt of that company, or its related parts, comes up for refinance turn round and say its lack of marketability means that the company is in jeopardy. It was obvious from the moment that PWC did the report on the Granite prospectus that its objectivity with regard to the audit was gone.

As Austin Mitchell MP (who has done much good work in this area along with Prem Sikka) said to the Observer:

The conflict of interest comes where [auditors] make the highest profits on other services, which means the audit becomes more compliant; more accommodating. They don't want to alienate the clients: the audit becomes a market stall from which they sell other services.

And perhaps as tellingly the Observer notes:

Rosemary Radcliffe, a non-executive director at Northern Rock, is a former chief economist at PwC.

She may have been the most scrupulous non-exec director on earth, but appearances matter. And this does not look good.

Surely then, now, when a British bank has been brought to its knees those of us who raise questions of the ethics and independence of our profession will be heard? Or am I being too optimistic?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] PWC has a lot to learn on such issues it seems to me. They’re far to common. […]

[…] thinking of PWC and its involvement with Northern Rock’s securitisation by any […]