I have spent some time talking to people about the 'shadow' structure that Northern Rock created and which I wrote about earlier this week. My question was simple, and I needed to be sure of the answer. I'm confident that I am now.

That simple question was this:

Why did Northern Rock create such a complicated structure for its debt?

The answer is this:

So that it could put the claims of its depositors below those of the City if anything went wrong with the company.

The shadow structure (which no doubt someone thought it very amusing to call 'Granite') was not a tax trick, at least as far as I can tell. Almost certainly very little profit flowed through the whole operation, which is why I am also convinced it is a flagrant abuse (but not breach) of charity law to have claimed it was set up with that purpose in mind.

Instead it was designed to ensure that the Granite companies, which are theoretically independent of Northern Rock, could always recover their money come what may and (very politely) sod the customers of the bank in that case.

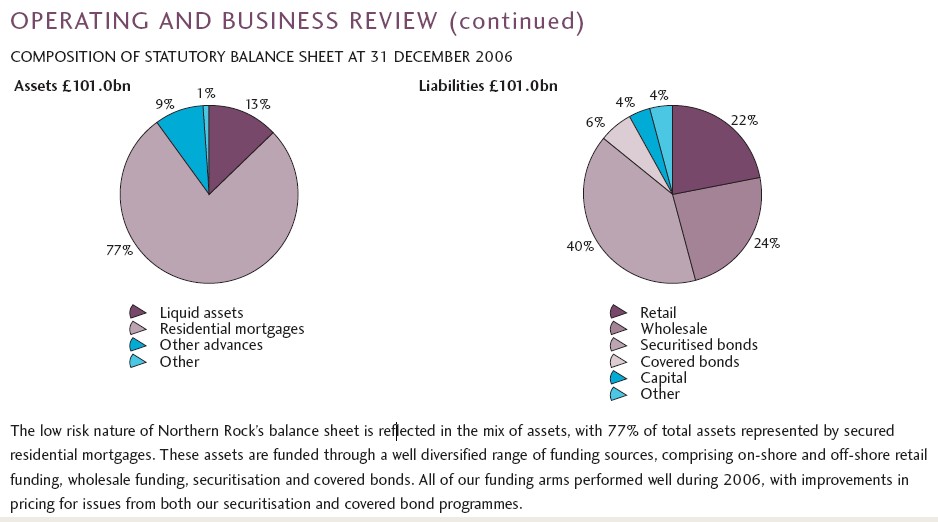

Look at this diagram of the last published Northern Rock balance sheet from their own 2006 accounts (page 38)(and laugh out loud at the nonsense written below it - with which the auditors must, by the way, have concurred):

The fact is that if Norther Rock did go down the 40% of securitised loans in the Granite companies and £30 odd billion in the 'wholesale' and 'covered' notes would all have had prior claim against the assets because of the way in which they were constructed. The people who were guaranteed to lose were the ordinary depositors of Northern Rock.

And because of the absurdly low capital structure of this so called bank follwoing its demutualisation a decade ago whilst the shareholders were always high risk takers in this game, they were vastly outnumbered in value by the depositors. Did those depositors know quite how much risk they were taking when lending funds to such an organisation?

Actually, instinctively they did. Those who queued this week were bang on the nail about the need to get out fast. They were at massive risk. But what's really shocking is this:

1) The FSA did not say this;

2) The Bank of England have not said this;

3) The Treasury have not said this. In fact, they went out of their way to say the exact opposite for several days.

The reality must be that each of these knew that the depositors in this organisation were being exposed to excessive and unreasonable risk because its directors had exposed them to it, deliberately. And no one in the City, and not one of those who has regulated this bank has said at any time:

You ordinary people were right. You rumbled us. You were right to queue.

Nor have they said:

The directors of this company did not protect you. In fact they abused you.

And no one has admitted:

We did not protect you. Not until we had to. And we only did it then to ensure that our previous failure to protect you was not exposed.

And together they have not said

All of us, directors, regulators and government alike put the interests of the City above the interests of the ordinary people of this country when regulating Northern Rock and as such let a bank operate to blatantly exploit you as a result.

But they should have. Because that's what happened. And they all know it. But they were happy with that massive misrepresentation in the Northern Rock accounts about the strength of its balance sheet, because from their perspective and that of their friends their risk was covered whatever happened. Who cared in that case about the ordinary people? It seems no one did.

Well it's time for many people to be called to account. Including those named above. I hope the Treasury Select Committee have fire in their bellies in this one. Because we sure need them to go into action, all guns blazing.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] Richard Murphy, whose Tax Research UK blog is hugely informative and brilliantly written, has uncovered the truth about Northern Rock’s liabilities: I have spent some time talking to people about the ’shadow’ structure that Northern Rock created and which I wrote about earlier this week. My question was simple, and I needed to be sure of the answer. I’m confident that I am now. […]

This story picked up by John McDonnell, MP for Hayes and Harlington, who is calling for a windfall tax on speculators benefiting from the Northern Rock crisis:

http://www.johnmcdonnell.org.uk/2007/09/windfall-

tax-speculators-profiteering.html

[…] I bet the owners of the last one are rubbing their hands with glee right now. I’d have loved to have been “cross sold” that. And remember, it’s this sort of debt that pulled down Northern Rock. […]

Dear Sir

I found your information very inetresting on Northern Rock.

Having watchd the news and researched a little on the internet it seems that ‘we’ ‘the nation’ are now going to suffer.

The debt from Northern Rock some 40 million is going to be paid off with tax payers money.

With the hospitals in dyer straights and our schools in need of urgent money , I believe this is truley wrong.

Do you have any further information on this?

Thanks

Tina

Tina

I think your interpretation not quite right

The Bank of England is supporting Northern Rock

The money has been loaned, not spent, although there is risk it may not be repaid in full

BUT, you are right to suggest that if money can be found so easily for this why not for hospitals and schools, where the government did not provide loans but did instead resort to the absurd PFI scheme

Richard

[…] http://www.taxresearch.org.uk/Blog/2007/09/21/northern-rock-those-in-the-queue-were-right/ […]